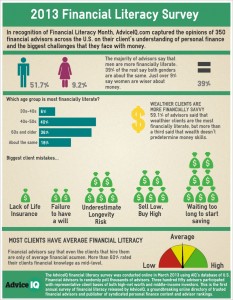

2013 Financial Literacy Survey

In recognition of Financial Literacy Month. AdvicelQ.com captured the opinions of 350

financial advisors across the U.S. on their client’s understanding of personal finance

and the biggest challenges that they face with money.

The majority of advisors say that

men are more financially literate.

39% of the rest say both genders

are about the same. Just over 9%

say women are wiser about

11151.7% II 9.2% money. 39%

Which age group is most financially literate?

WEALTHIER CLIENTS ARE

30s-40s MORE FINANCIALLY SAVVY

59.1% of advisors said that

40s-50s 40% wealthier clients are the most

financially literate, but more than

60s and older 36% a third said that wealth doesn’t

predetermine money skills.

About the same 18%

Biggest client mistakes…

aa

9 9 9

aa aa aa

9 9 9 .. 9

aaa aaa

Lack of Life Failure Underestimate Sell Low, Waiting too

Insurance to have Longevity Buy High long to start

a will Risk saving

Average

MOST CLIENTS HAVE AVERAGE FINANCIAL LITERACY

Financial advisors say that even the clients that hire them

are only of average financial acumen. More than 60% rated

their clients financial knowlege as mid-level

Low High

The Advice11.1 financial literacy survey was conducted online in March 2013 using AIQ’s database of U.S.

Financial Advisors to randomly poll thousands of advisors. Three hundred fifty advisors participated

with representative client bases of both high-net worth and middle-income investors. This is the first

annual survey of financial literacy released by Advicell a groundbreaking online directory of trusted

financial advisors and publisher of syndicated personal finance content and advisor rankings.